2024 in Figures

Delen Private Bank's assets under management rose to record levels again in 2024, across all regions where the bank operates. This growth was driven by both organic expansion and acquisitions, as well as by positive market performance. Our integrated approach – combining responsible investing with forward-looking, tailored wealth planning – continued to attract both new and existing clients.

Message from our CEO

'Delen Private Bank, since 1936' is the slogan that has graced our brochures for quite some time now. Next year marks ninety years since André Delen laid the foundations of the bank. Back then, Delen was essentially a start-up. And in our hearts and minds, it still is. Today, we feel the same drive, curiosity, and determination to provide our clients with the very best service – just as André Delen did when he opened his small exchange office in Antwerp.

Assets under management at record levels

Delen Private Bank's assets under management rose to new record levels in 2024. This impressive growth was not only driven by a favourable stock market performance, but also by strong organic capital inflows at Delen Private Bank Continental (Belgium, the Netherlands, Luxembourg, and Switzerland), as well as an acceleration of acquisition activities in the Netherlands.

Growth through organic inflow and acquisitions

Delen’s strong growth trajectory in Belgium continue

Increase in offices and AuM

Growth in the Netherlands shifts into higher gear

Increase in number of offices and AuM

Emphasis on dialogue in responsible investing

As at 31 December 2024, Delen Private Bank invested €47.6 billion of its customer assets through the funds managed by Cadelam, the bank's fund manager. All these investment funds, without exception, consistently apply Delen Private Bank's responsible investment policy.

Cadelam and Delen Private Bank, as active shareholders, are committed to engagement as a means to drive sustainable change. In collaboration with Federated Hermes EOS, they engage in dialogue with companies on ESG-related topics. The priorities for these engagements are set annually. In 2024, EOS engaged with 83% of the companies in the equity portfolio, focusing on environmental issues, social matters, good governance, and strategy. In total, 1,719 engagement actions were undertaken with 287 companies.

ESG topics addressed through engagement in 2024

New offices, strengthened relationships

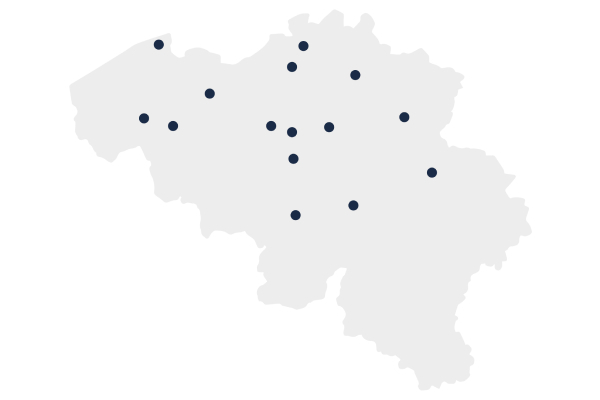

Being close to the client is one of the cornerstones of Delen’s service philosophy. In Belgium, this is clearly illustrated by the opening of nine new offices over the past seven years. By the end of 2024, Delen Private Bank operated fifteen branches in its home market. The new office in Knokke was inaugurated in December 2024, sparking new momentum. Our new branch in Wavre opened in May 2025.

In the Netherlands, the bank’s acquisition activity intensified, with expansions into promising regions such as The Hague and Eindhoven. This further strengthened the Netherlands’ role as the group’s second strategic hub. In January 2024, the asset deal with Puur Beleggen was completed. Two months later, Box Consultants was acquired and consolidated in October 2024. As a result, Delen Private Bank Netherlands contributed €3.4 billion to total AuM in 2024 — a significant increase from €1.4 billion in 2023.

Employees at the heart of our personalised service

To ensure the continuity of our hallmark service characteristics - personal, available, and accessible - the bank expands its workforce year after year. It is actively recruiting across IT, commercial, and support functions. The key advantages for our clients — a personal approach, operational excellence, and responsiveness — are only possible thanks to the full commitment, motivation, and professionalism of all our teams.

Healthy efficiency, profitability, and stability

Other highlights in 2024

Interested in a deeper dive into the numbers?

The comprehensive summary provides further insight into our bank’s mission, strategy, and activities, along with a detailed report on the financial and ESG performance for 2024.